You’re scrolling through land listings, dreaming of owning your own piece of Kenya, but then reality hits; you’re still paying HELB. That monthly deduction from your salary is a constant reminder of your student loan debt. The question that’s been nagging you is: “Can I actually buy land while I’m still paying HELB?”

If you’re a young Kenyan graduate juggling HELB repayments and land ownership dreams, you’re not alone. Thousands of Gen Z professionals are asking the same question. The good news? There’s no law stopping you from buying land while paying HELB in Kenya, but there are smart and not-so-smart ways to go about it.

This comprehensive guide will walk you through everything you need to know about balancing student loans and land investment in Kenya, helping you make informed decisions that won’t jeopardize your financial future.

How HELB Loans Affect Your Finances

Understanding how HELB impacts your financial capacity is crucial before making any land investment decisions. When you’re employed, HELB automatically deducts a percentage of your gross salary typically 1% of your gross pay for most graduates, though this can vary based on your loan amount and repayment plan.

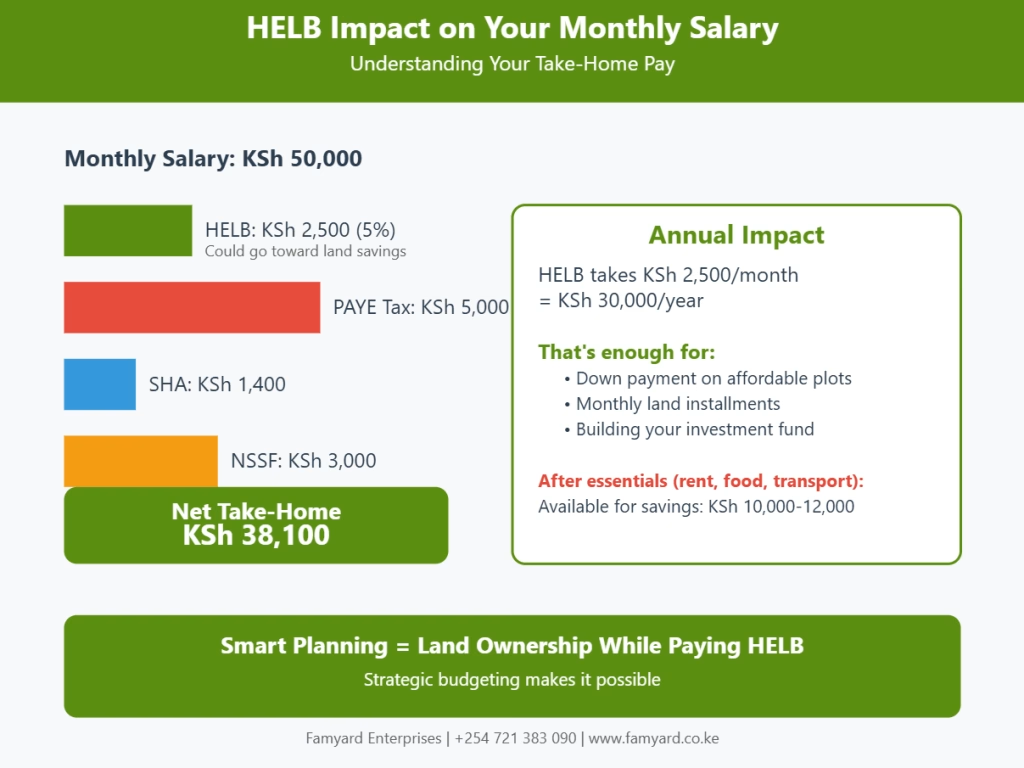

Let’s break down the real impact with a practical example:

Monthly Salary: Ksh 50,000

HELB Deduction: Ksh 2,500 (assuming 5% of gross salary)

PAYE Tax: Ksh 5,000

SHA: Ksh 1,400

NSSF: Ksh 3000

Net Take-Home: Approximately Ksh 38,100

This means HELB is taking Ksh 2,500 from your monthly budget that could otherwise go toward land savings. Over a year, that’s Ksh 30,000 enough for a down payment on some affordable plots.

Credit Reference Bureau (CRB) Implications

Your HELB loan appears on your credit report, which banks and financial institutions check when you apply for additional loans. While this doesn’t prevent you from buying land with cash or flexible payment plans, it might affect your ability to secure a land loan or mortgage.

Disposable Income Reality

After rent (let’s say Ksh 15,000), food (Ksh 8,000), transport (Ksh 5,000), and other essentials, you might have Ksh 10,000-12,000 left for savings and investments. This is where strategic planning becomes essential.

Is It Legal to Buy Land While Paying HELB?

Let’s address the elephant in the room, there is absolutely no law in Kenya that prohibits you from buying land while paying HELB. This is a common misconception that has prevented many young Kenyans from starting their property investment journey.

What the Law Actually Says:

- HELB is a loan, not a legal restriction on your property rights

- You can legally purchase, own, and transfer land titles regardless of your HELB status

- Your employment contract and HELB agreement don’t restrict property ownership

Common Myths Debunked:

- Myth: “HELB will seize my land if I default”

- Reality: HELB can only recover debts through salary deductions and CRB listings, not property seizure

- Myth: “I can’t get a title deed while paying HELB”

- Reality: Title deed processing is independent of your loan status

- Myth: “My employer will fire me for buying land while paying HELB”

- Reality: Your property investments are personal matters, not employment issues

While it’s legal, the key question isn’t whether you can buy land while paying HELB, but whether you should based on your financial situation. This requires honest assessment of your income, expenses, and long-term goals.

Smart Ways to Save for Land While Paying HELB

Buying land while managing HELB repayments requires creative financial strategies. Here are proven methods young Kenyans are using:

- Side Hustles and Multiple Income Streams

- Freelancing: Use your skills for graphic design, writing, or digital marketing

- Online businesses: Drop shipping, affiliate marketing, or selling digital products

- Weekend jobs: Part-time work that doesn’t interfere with your main job

- Skill monetization: Tutoring, coaching, or offering professional services

- Joining SACCOs and Investment Groups SACCOs offer several advantages for land buyers:

- Lower interest rates than banks

- Flexible repayment terms

- Group investment opportunities

- Access to land-specific loan products

- Flexible Payment Plans Many land companies, including Famyard, offer installment plans that work with your budget:

- Monthly payments

- Extended payment periods

- No interest on some plans

- Ability to adjust payments based on income changes

- Strategic Savings Techniques

- Automated savings: Set up automatic transfers to a dedicated land fund

- Percentage-based saving: Save a fixed percentage of any income increases

- Bonus allocation: Direct work bonuses, overtime, or windfalls toward land savings

- Expense reduction: Cut unnecessary subscriptions and optimize spending

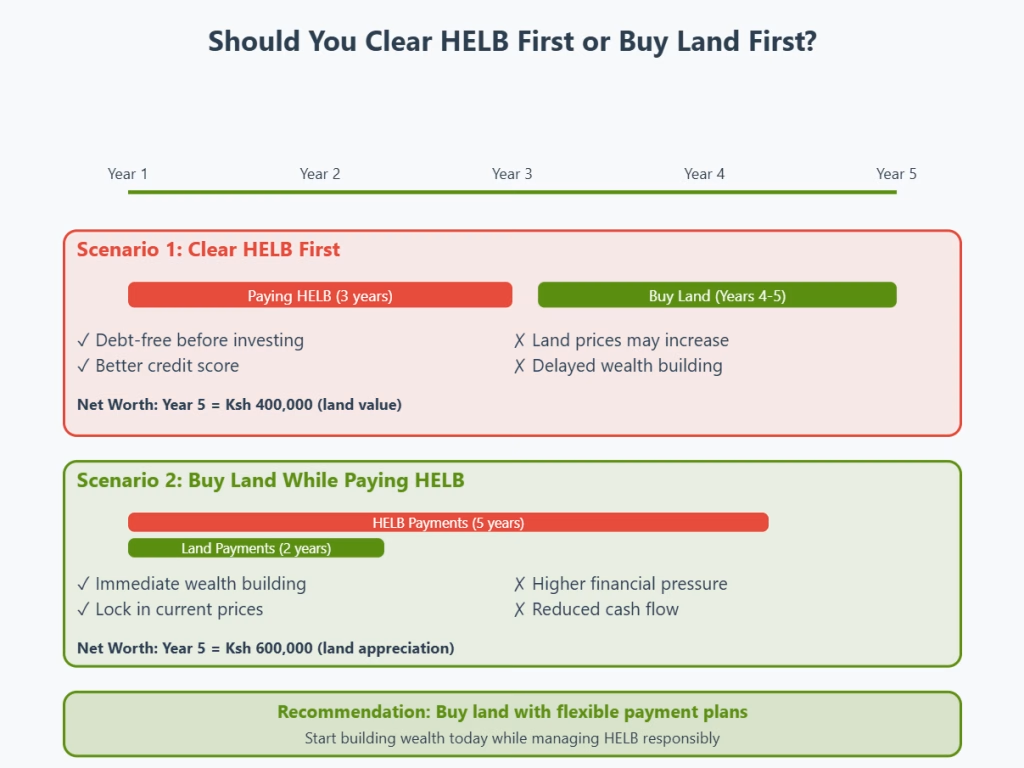

Should You Clear HELB First or Buy Land First?

This is one of the questions that doesn’t have a one-size-fits-all answer. Let’s examine both approaches:

Clearing HELB First:

Pros:

- Improved credit score and borrowing capacity

- Reduced monthly financial commitments

- Peace of mind from debt freedom

- Easier qualification for land loans

Cons:

- Land prices may increase while you’re paying off HELB

- Missed investment opportunities

- Delayed wealth building

- Inflation erodes purchasing power

Buying Land First:

Pros:

- Land typically appreciates faster than HELB interest accumulates

- Start building wealth immediately

- Lock in current land prices

- Generate potential rental income (if applicable)

Cons:

- Increased financial pressure

- Limited borrowing capacity

- Risk of overextension

- Potential cash flow challenges

Start Your Land Ownership Journey Today

The truth is, you don’t have to wait until you’ve cleared your HELB to start building wealth through land ownership. With proper planning, realistic budgeting, and the right payment plan, you can begin your property investment journey today.

Your Next Steps:

- Calculate your exact disposable income after HELB and essentials

- Research affordable plots in your preferred areas

- Compare payment plans from different land companies

- Start with what you can afford – even a small plot is a great beginning

Ready to Explore Your Options?

Don’t let HELB hold back your dreams of land ownership. At Famyard Enterprises, we’re committed to helping young Kenyans achieve their property goals through flexible, affordable solutions.

Contact us today for a free consultation:

- Call Us: +254 721 383 090

- Email: contact@famyard.co.ke

- Website: www.famyard.co.ke

Book a site visit and discover how you can own land in Central Kenya with payment plans that work around your HELB commitments. Your future self will thank you for starting today.