Land investment in Kenya presents incredible opportunities, but as a first-time investor, you are prone to fall into predictable traps that could cost you thousands of shillings and months of frustration. Hence, understanding these common pitfalls can save you from expensive lessons learned the hard way. This guide presents five common mistakes you may fall into as a first-time land investor and tips on how you can dodge them.

1. Skipping Proper Due Diligence on Title Documents

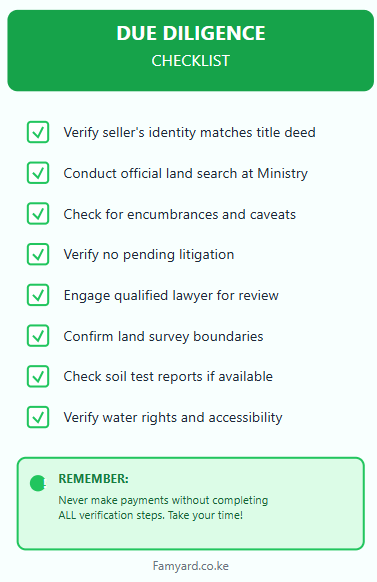

As a first-time investor, you may get excited about a piece of land and rush to make payments without thoroughly verifying ownership documents. This enthusiasm often leads to purchasing land with disputed ownership, forged titles, or properties under legal battles.

Unfortunately, the Kenyan land registry system still contains irregularities despite undergoing various improvements. In this case, some sellers present convincing fake documents, while others may not have clear title to the land they’re selling. Without proper verification, you might find yourself in court fighting for land you thought you owned.

Hence, you should always conduct a search at the Ministry of Lands offices to avoid falling victim to such practices. Also, verify that the seller’s identity matches the details highlighted in the title deed. If in doubt, engage a qualified lawyer to review all documents before any payment, including encumbrances, caveats, or pending litigation on the property. This process might take a few weeks, but it’s infinitely better than losing your investment.

2. Ignoring Location and Infrastructure Development Plans

Location is the greatest driver for land value more than any other factor, yet, you are likely to solely focus on price as a first-time investor. As a result, you may purchase land in remote areas without considering access roads, water availability, electricity connectivity, or future development plans.

You may get attracted to extremely cheap land without questioning why it’s priced so low. Often, these properties lack basic infrastructure or sit in areas with no development potential. You may also miss opportunities in areas earmarked for major infrastructure projects that could significantly increase land values.

As a first-time land investor, always research the county development plans and national infrastructure projects. Visit the area multiple times at different periods to identify any challenges with accessibility. Also check with local authorities about planned roads, water projects, or other developments. Lastly, consider proximity to schools, hospitals, and commercial center, factoring in the cost of bringing basic utilities to remote locations when calculating your total investment.

3. Underestimating the Total Cost of Land Purchase

Most of the time, the advertised price represents just the beginning of your financial commitment. As a first-time investor, you are likely to budget for the land cost and get caught off-guard by additional expenses that can add 15-25% to your total investment.

These hidden costs include stamp duty, often, 4% of land value, legal fees, survey costs, search fees, registration fees, and agency commissions. For properties requiring subdivision, you should add survey fees and approval costs. Nonetheless, if you need financing, you need to factor in loan processing fees and interest rates.

The most effective way to dodge this is to create a comprehensive budget that includes all associated costs before making any commitments. If possible, get quotes from lawyers, surveyors, and other professionals upfront. Besides, set aside an additional 10% buffer for unexpected expenses. Lastly, consider all costs when comparing different properties as a slightly more expensive property with clear documentation might cost less overall than a cheaper one requiring extensive legal work.

4. Falling for High-Pressure Sales Tactics

Land sales in Kenya often involve aggressive marketing tactics designed to create urgency. As a first-time investor, you may frequently encounter phrases like “prices increasing tomorrow,” “only two plots remaining,” or “special discount ending today.” These pressure tactics may push you into making hasty decisions without proper evaluation.

In some cases, developers organize site visits with transportation provided, create artificial scarcity, or offer payment plans that seem too good to be true. While legitimate developers use marketing strategies, distinguishing between normal sales pressure and manipulation requires experience that you may lack as a first-time investor.

Therefore, you should avoid making land purchase decisions on the same day you first see a property. Always insist on time to conduct your own research and be wary of deals that seem significantly below market rates without clear justification. Also, get independent valuations and compare prices across multiple similar properties. Always trust your instincts, if something feels too rushed or too good to be true, step back and investigate further.

5. Neglecting to Verify Development Approvals and Restrictions

As a first-time investor, you may assume you can develop your land however you want once you own it. This assumption may lead to costly surprises when you discover zoning restrictions, environmental constraints, or missing development approvals that limit your intended use.

Note that some areas require specific approvals from multiple authorities before any development can begin. Others fall under environmental protection zones with strict building limitations. Moreover, agricultural land may have restrictions on subdivision or non-agricultural use. Failing to understand these limitations upfront can derail your entire investment strategy.

You should always verify the land’s zoning classification and permitted uses with county planning departments before purchasing land. Check environmental impact requirements with the National Environment Management Authority (NEMA), understand any agricultural land conversion requirements and factor approval timelines and costs into your development plans. Lastly, consult with local authorities about any planned zoning changes that might affect your property.

Ready to invest in land with confidence?

At Famyard.co.ke, we eliminate the guesswork from land investment. Our team handles comprehensive due diligence, legal verification, and connects you with pre-verified properties that match your investment goals. From title searches to development approval guidance, we ensure your land purchase journey is smooth, transparent, and secure.

Contact us today to explore verified land investment opportunities across Kenya. Let our expertise protect your investment while you focus on building your future.