When you purchase that 50×100 plot in Nanyuki, Nyeri, or Karatina through Famyard Enterprises, you’re not just buying land, you’re investing in Central Kenya’s most promising growth corridor. But what should you realistically expect as your land investment returns over the next five years?

Understanding Central Kenya’s Land Market Dynamics

Central Kenya, particularly the Mount Kenya region, has emerged as one of the most stable and promising land investment destinations in the country. Our properties in Nanyuki, Nyeri, Karatina, Mweiga, and Jikaze sit at the heart of this growth story, benefiting from unique advantages that drive consistent appreciation.

The region’s strategic location between Nairobi and northern Kenya, combined with its agricultural potential and growing tourism sector, creates multiple value drivers. Historical data from our sales shows that properties in these areas have experienced annual appreciation rates of 12-18%, significantly outperforming many other regions.

Why Central Kenya Properties Outperform

Agricultural Advantage

Unlike purely speculative investments, our properties sit in Kenya’s most productive agricultural region. The fertile volcanic soils around Mount Kenya ensure that land retains inherent value beyond speculation. Coffee, tea, and horticultural farming provide steady income potential for those who choose to farm their plots.

Tourism Growth

The Mount Kenya region attracts both domestic and international tourists year-round. Properties in Nanyuki particularly benefit from this trend, with potential for hospitality developments, vacation homes, and recreational facilities. The ongoing recovery of Kenya’s tourism sector suggests strong future demand.

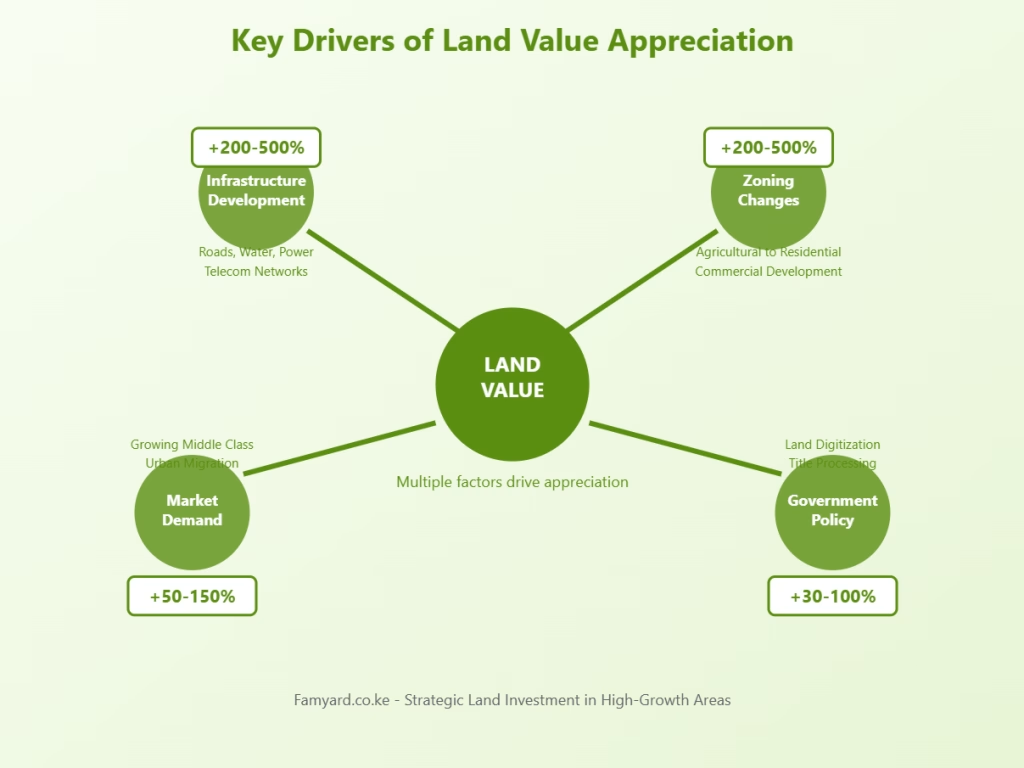

Infrastructure Development

The region benefits from existing good infrastructure that continues to improve. The Northern Corridor highway, ongoing rural electrification, and expanding mobile network coverage all contribute to land value appreciation. County governments in Nyeri and Laikipia have demonstrated commitment to infrastructure development through their budgetary allocations.

Climate Advantage

Central Kenya’s temperate climate makes it increasingly attractive as other regions face climate challenges. The area’s reliable rainfall patterns and cooler temperatures appeal to both retirees and those seeking escape from Nairobi’s heat and congestion.

The Hidden Costs of Land Ownership

Your gross returns aren’t your net returns. Here’s what you need to consider when assessing your land investment returns.

- Annual land rates – Expect to pay KES 1,500-4,000 annually per quarter-acre in land rates, depending on the specific location and county. Over five years, this totals KES 7,500-20,000.

- Basic maintenance – Most of our properties require minimal maintenance, but budget KES 20,000-50,000 over five years for basic upkeep, especially if you choose to fence your plot or maintain access roads.

- Transaction costs – When selling, expect to pay 3-5% of the sale price in legal fees, stamp duty, and agent commissions. On a KES 1.5 million sale, this could be KES 45,000-75,000.

Market Timing and Liquidity in Central Kenya

Central Kenya’s land market offers better liquidity than many other regions. Properties in Nanyuki and Nyeri typically sell within 2-4 months due to steady demand from both investors and end-users. The region’s established agricultural economy and growing middle class ensure consistent buyer interest.

Peak selling seasons align with harvest periods (October-December) and school holidays when diaspora Kenyans return home. Planning your sale during these periods can add 10-15% to your final price.

Maximizing Returns on Your Land Investment From Famyard Enterprises

- Strategic plot selection – Our properties near town centers or along major roads consistently outperform remote locations. For instance, a plot 2 kilometers from Nanyuki town center will likely appreciate faster than one 10 kilometers away, despite similar soil quality.

- Value addition opportunities – Consider basic improvements like fencing, tree planting, or even small-scale farming. These improvements not only generate income but also increase your property’s marketability and final sale price.

- Timing your purchase – We occasionally offer special promotions during off-peak seasons. Buying during these periods can improve your overall returns by 5-10%.

Regional Variations Within Our Portfolio

- Nanyuki properties offer the highest liquidity and most predictable returns due to the town’s established status and tourist appeal. Expect steady 12-15% annual appreciation.

- Nyeri outskirts provide excellent value with potential for both agricultural use and future residential development. Growth rates typically range from 10-14% annually.

- Karatina and Mweiga represent our best value propositions, with potential for above-average returns as infrastructure development reaches these areas. Annual appreciation could reach 15-20% for well-positioned plots.

- Jikaze properties offers the highest risk-reward ratio in our portfolio, with potential for extraordinary returns if transport infrastructure develops as planned.

Weather and Climate Considerations

Central Kenya’s favorable climate adds to investment appeal. Unlike coastal properties that face storm risks or arid regions with water challenges, our properties benefit from reliable rainfall and temperate conditions year-round. This climate advantage increasingly attracts buyers seeking long-term stability.

The Agricultural Income Potential

Many of our clients generate income from their plots while waiting for appreciation. 50×100 plots in our areas can yield;

- Coffee farming: KES 30,000-80,000 annually after establishment

- Vegetable farming: KES 40,000-100,000 annually with proper management

- Tree farming: Long-term income potential through timber or fruit production

The Bottom Line on Famyard Properties

Realistic expectations for five-year returns on Famyard properties range from 60% to 140%, depending on location and market conditions. This translates to annual returns of 10-19%, which compares favorably to most other investment options available to Kenyan investors.

Our properties in Central Kenya offer several advantages over land investments elsewhere, including better infrastructure, reliable climate, agricultural potential, and steady demand from both investors and end-users. Additionally, the region’s proximity to Nairobi, without the high prices of traditional investment areas, makes it particularly attractive.

Success with land investment isn’t just about buying and waiting. The most successful investors in our portfolio stay informed about local developments, maintain their properties properly, and time their transactions strategically. We provide ongoing market updates and support to help you maximize your investment returns.

Your plot’s value in 2030 will largely depend on the location you choose today and how well you maintain and potentially improve the property. Central Kenya’s land market rewards patience, strategic thinking, and local knowledge.

Ready to invest in Central Kenya’s most promising properties? Visit Famyard.co.ke to explore our current inventory in Nanyuki, Nyeri, Karatina, Mweiga, Jikaze, among others. Our experienced team provides comprehensive market analysis and helps you select the perfect plot for your investment goals. Start building your land portfolio in Kenya’s agricultural heartland today.