Buying land in Kenya remains one of the most secure investment decisions you can make. However, navigating the complex world of land loans requires careful consideration of what banks offer versus what they actually deliver.

The Good: Why Land Loans Make Sense

Land loans provide immediate access to property ownership without depleting your savings. Unlike other investments that fluctuate with market conditions, land in Kenya has consistently appreciated over the years.

Most Kenyan banks offer competitive interest rates ranging from 12% to 18% annually for land loans. The repayment periods extend up to 15 years, making monthly installments manageable for middle-income earners. Banks like NCBA, Absa, and Cooperative Bank have streamlined their application processes, with some approvals taking as little as two weeks.

The flexibility of land loans allows you to secure property while continuing other investments. You can develop the land gradually or hold it as an appreciating asset while servicing the loan from your regular income.

The Bad: Hidden Realities of Land Financing

The advertised interest rates rarely tell the complete story. Most banks quote reducing balance rates, but the effective annual rate often exceeds 20% when you factor in additional charges. Many borrowers discover this only after signing loan agreements.

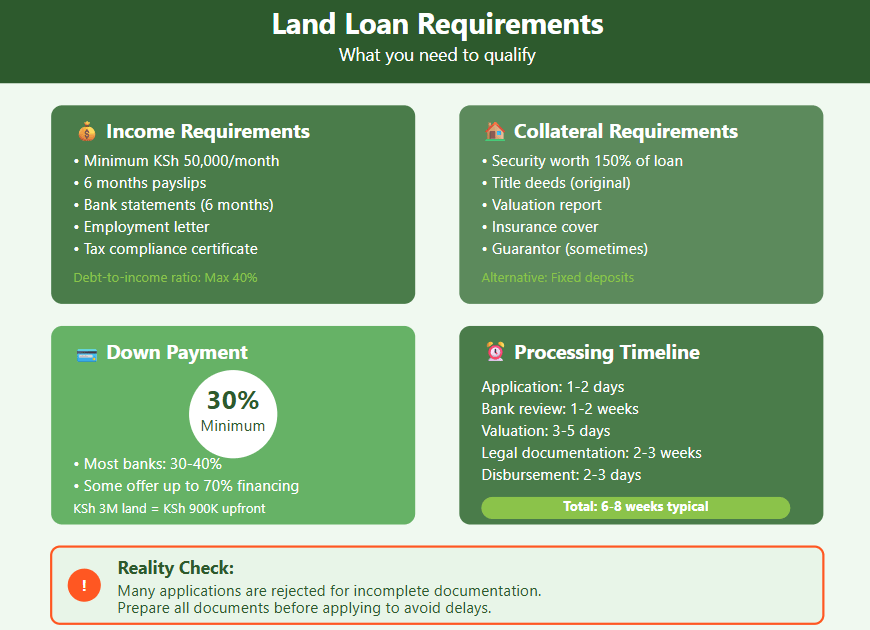

Collateral requirements can be stringent. Banks typically demand security worth 150% of the loan amount. If you’re buying a Ksh 2 million plot, you’ll need collateral valued at Ksh 3 million. This requirement locks up significant assets that could otherwise generate income.

The loan-to-value ratio rarely exceeds 70%, meaning you must provide at least 30% upfront. For a Ksh 5 million land purchase, you’ll need Ksh 1.5 million cash, which defeats the purpose for many buyers seeking 100% financing.

Processing times can stretch beyond promised timelines. While banks advertise quick approvals, land verification, title searches, and legal documentation often take 6-8 weeks. Market opportunities can disappear during these delays.

The Hidden Charges: What Banks Don’t Advertise

First, processing fees typically range from 1-2% of the loan amount. Therefore, for a Ksh 3 million loan, expect to pay Ksh 30,000-60,000 upfront before receiving any funds. Additionally, legal fees for documentation, including loan agreements and security documentation, can cost Ksh 50,000-150,000 depending on the loan size. Banks often insist on using their panel of lawyers, limiting your ability to negotiate these costs.

Valuation fees for the land you’re purchasing range from Ksh 25,000-50,000. Banks require independent valuations regardless of recent sales prices or your own assessment. Moreover, insurance premiums for loan protection insurance can add 2-3% annually to your repayment burden. While marketed as optional, most banks make this a prerequisite for loan approval.

Nonetheless, early repayment penalties can reach 3-5% of the outstanding balance. If you come into money and want to clear your loan early, banks penalize this financially prudent decision. Also, land search fees, consent fees, and stamp duty costs are often excluded from initial loan calculations but can add Ksh 100,000-300,000 to your total investment.

Making Land Loans Work for You

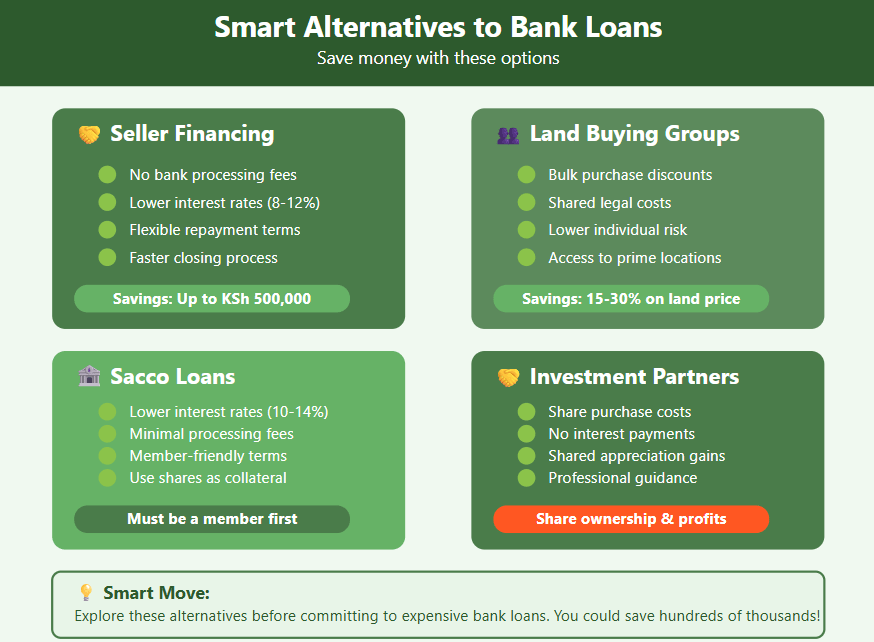

First, compare total cost of borrowing across multiple banks, not just advertised interest rates. If possible, request detailed breakdowns of all charges before committing to any lender. Also, consider seller financing options where property owners accept direct payments over time. This eliminates bank charges while potentially securing better interest rates. Lastly, negotiate package deals where banks waive certain fees in exchange for maintaining other accounts or services with them.

Ready to secure your piece of Kenya? Get expert guidance on land loans and property investment strategies. Visit Famyard.co.ke today for personalized advice that saves you money and secures your future.