Picture this: You’re 25, just got your first job, and you’ve finally saved your first serious money, maybe 300K sitting in your account. Your WhatsApp status probably reads “God’s timing is the best” because, honestly, saving that much in Kenya isn’t a joke. Now comes the big question that’s keeping you up at night: Should you get that clean Vitz you’ve been eyeing, or should you buy a 50×100 plot in Nanyuki?

Your boys are telling you to get the car while your parents are whispering about land, saying cars are an expense. Meanwhile, you’re stuck scrolling through Cheki and property listings, wondering which decision will set you up for life.

If you’re reading this, you’re already ahead of most people because you’re thinking long-term. Let’s break down the real talk about buying land vs. buying a car in Kenya so you can make a decision that your future self will thank you for.

The Reality of Buying a Car First

Let’s be honest, there’s something sweet about having your own ride. No more waiting for matatus in the rain, no more awkward conversations with boda guys about the fare, and definitely no more “I’ll pick you up” lies when you’re trying to impress someone.

The Good Side of Getting a Car First

Mobility Freedom

In Nairobi traffic, having a car means you control your schedule. You can leave the house at 6 AM to beat traffic or work late without worrying about catching the last mat to your estate. For side hustles, whether it’s Uber, delivering cakes, or running errands for busy executives, a car opens doors.

Professional Image

Let’s not pretend that image doesn’t matter in Kenya. Rolling up to that interview or client meeting in your own car does create a certain impression. Some opportunities come more easily when you look “established.”

Convenience for Family

When your mom is sick and needs to get to the hospital, or when you need to help your cousin move houses, having a car makes you the family hero. These moments matter more than money sometimes.

The Reality Check

Depreciation is Real

That 300K car you buy today will be worth maybe 180K in three years. Cars lose value faster than ice cream melts in the Mombasa sun. It’s not an investment; it’s an expense that keeps eating your money.

Hidden Costs Hit Different

Insurance (30K annually), fuel (15K monthly if you’re conservative), servicing (20K quarterly), parking fees, toll fees, and that random breakdown that always happens when you’re broke. Before you know it, you’re spending 80K+ annually just to keep the car running.

The Stress is Real

Parking in town is a nightmare. Carjacking fears. Hitting potholes that cost 15K to fix. Traffic jams that make you question your life choices. Sometimes you’ll miss the simplicity of hopping on a mat.

The Reality of Buying Land First

Now, let’s talk about the land option, the choice that doesn’t give you instant gratification but might set you up for life.

Why Land Makes Sense

Value Growth

That 300K plot in Kiambu today might be worth 600K in five years. Land near developing areas like Konza, Tatu City, or along the new roads appreciates consistently. It’s like having a savings account that actually beats inflation.

Future Security

Land gives you options. Build a rental property, start a business, or just sell when you need serious money. It’s your backup plan, your retirement fund, and your children’s inheritance all rolled into one.

No Monthly Expenses

Once you buy land, it just sits there growing in value. No fuel, no insurance, no maintenance, just pure appreciation. You can literally forget about it for years and come back to find it’s worth double.

The Challenges

Requires Due Diligence

Land buying in Kenya can be tricky. You need to verify titles, check zoning, understand payment plans, and avoid grabbing cases. It’s not as simple as walking into a showroom and driving away.

Cash Flow Timing

If you’re still renting and using public transport, buying land first means you’ll keep paying rent and transport costs while your money is tied up in an asset you can’t immediately use.

Key Factors to Consider Before Deciding

Your decision shouldn’t be based on what your friends are doing or what looks cool on Instagram. Here are the real factors that should guide your choice:

Your Income Stability

If you’re in a stable job with predictable growth, land might be smarter. If you’re in sales, freelancing, or gig work where a car could boost your income, consider the mobility first.

Where You Live and Work

Living in Rongai and working in Westlands? A car might save you sanity and time. Living in Eastlands and working in town? The mat might still be more economical.

Family Situation

Are you supporting parents or siblings? Do you have kids? A car provides immediate utility for family needs, while land provides long-term security.

Your Long-term Vision

Planning to immigrate? Buy land. It’s easier to manage property remotely than to ship a car. Planning to stay and build a business? Consider how each option supports your goals.

Side Hustle Potential

Can you make money with the car through Uber, delivery services, or weekend gigs? Can you afford to let the land sit without generating income?

Real Numbers: How 300K Spent on Land vs Car Grows

Let’s crunch some actual numbers to see how your 300K performs in both scenarios:

Scenario 1: Buying a 300K Car (2011 Vitz)

- Year 1: Car value = 280K, Annual costs = 80K

- Year 3: Car value = 220K, Cumulative costs = 240K

- Year 5: Car value = 180K, Cumulative costs = 400K

- Total cost to you: 520K for an asset worth 180K

Scenario 2: Buying a 300K Plot (50×100 in Nanyuki)

- Year 1: Land value = 320K (6% appreciation)

- Year 3: Land value = 380K

- Year 5: Land value = 450K

- Total gain to you: 150K profit, plus you still own the land

The numbers don’t lie. While you’re spending 520K to own a depreciating car, the land buyer has made 150K profit and owns an appreciating asset.

Smart Options: Can You Do Both?

Here’s where it gets interesting- maybe you don’t have to choose. Smart young Kenyans are finding ways to have both:

The Graduated Approach

Start with the plot, then save for a car over the next 2-3 years. By the time you buy the car, your land has already appreciated, essentially funding part of your car purchase.

The Income Booster Method

If a car will significantly boost your income (through Uber, business, or better job opportunities), get the car first, use the extra income to buy land within the next two years.

The Location Play

Buy land in an upcoming area with good transport links. Live near the plot, rent cheaply, use public transport, and watch your investment grow.

How Famyard Helps Young Investors Get Started

At Famyard Enterprises, we understand that young professionals need flexible, secure ways to enter the property market. We’ve designed our services specifically for people like you who are making their first major investment decision.

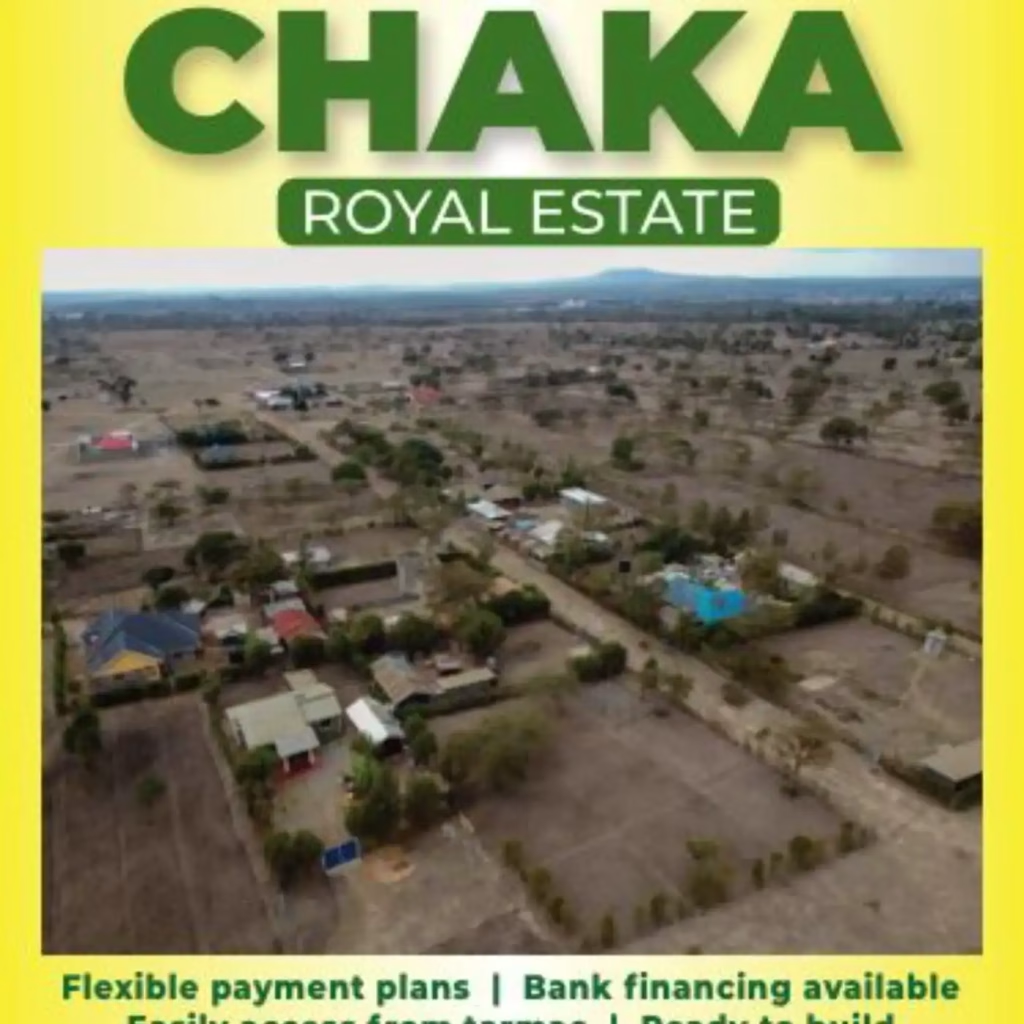

- Prime locations: Our plots are in strategic locations along major roads and near upcoming developments. Areas like Chaka, Nanyuki, Jikaze, Nyeri where your 300K today becomes 600K in five years.

- Secure documentation: We handle all the paperwork, title searches, and legal requirements. You get genuine titles, proper surveying, and secure ownership without the usual land-buying stress.

- Site visits and transparency: We organize site visits so you can see exactly what you’re buying. No surprises, no hidden fees, no last-minute changes to the deal.

- Young professional support: Our team understands the unique challenges young investors face. We provide guidance on everything from financing options to future development possibilities.

Frequently Asked Questions

- Is it better to buy a car or land first? It depends on your situation. If you need mobility for work or business, start with a car. If you want long-term wealth building, land appreciates while cars depreciate.

- Can I buy land with a loan? Yes, some banks offer land loans, but they typically require higher deposits and have stricter terms than car loans. Payment plans from developers are often more flexible.

- Do I need a big salary to buy land? No. With payment plans, you can secure land with a deposit of 30% then pay monthly installments. A 15K monthly payment is manageable for most young professionals.

- Should I buy land while still renting? Yes, if you can afford both. Land is a long-term investment that grows while you’re still renting. You can always build or sell later when you’re ready.