When purchasing land in Kenya, stamp duty represents one of the most significant costs you’ll encounter beyond the property price itself. This government tax, administered by the Kenya Revenue Authority (KRA), applies to all land transactions and varies based on several factors that every buyer should understand.

What is Stamp Duty?

Stamp duty is a tax imposed on legal documents that transfer ownership of property. In Kenya, this tax must be paid before the Registrar of Lands can process your land transfer documents. Think of it as the government’s way of officially recognizing and recording your property transaction.

Current Stamp Duty Rates

The stamp duty rates in Kenya depend on the property’s location and value:

Urban Areas (Nairobi, Mombasa, Kisumu, Nakuru, Eldoret)

- Properties valued up to KSh 3 million: 2% of the property value

- Properties valued above KSh 3 million: 4% of the property value

Other Areas

- Properties valued up to KSh 3 million: 1% of the property value

- Properties valued above KSh 3 million: 2% of the property value

For example, if you’re buying a plot worth KSh 2 million in Nairobi, you’ll pay KSh 40,000 in stamp duty (2% of KSh 2 million). However, if that same plot is located in Nyeri, you’ll pay KSh 20,000 (1% of KSh 2 million).

How Property Value is Determined

The stamp duty calculation is based on either the purchase price or the government’s assessed value, whichever is higher. The government uses land valuation rates set by the Ministry of Lands, which are periodically updated to reflect current market conditions.

This means you cannot simply declare a lower purchase price to reduce your stamp duty obligation. The KRA will use the higher of the two values, ensuring fair taxation while preventing undervaluation of properties.

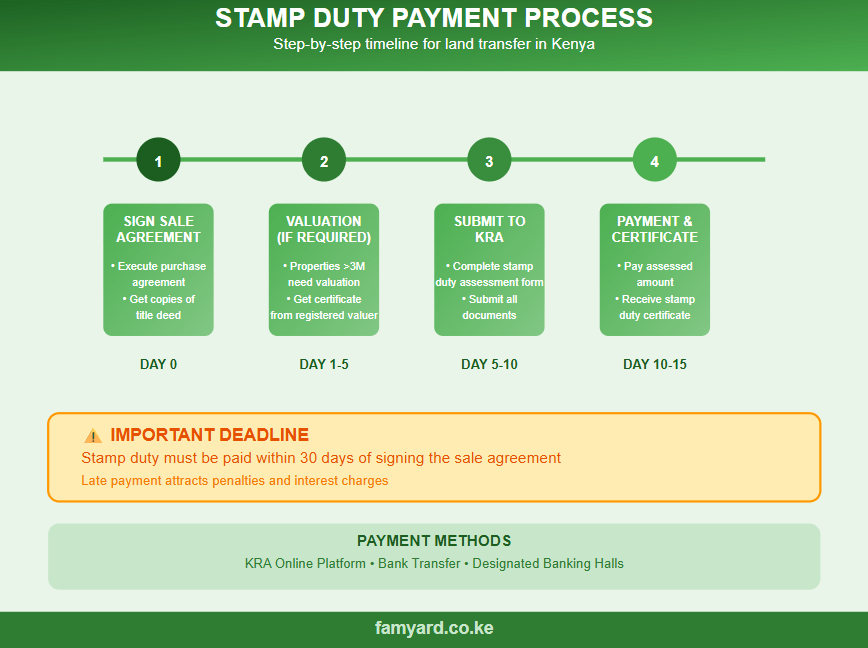

Payment Process and Timeline

Stamp duty must be paid within 30 days of signing the sale agreement. The payment process involves several steps:

First, obtain a valuation certificate from a registered valuer if the property value exceeds KSh 3 million. Next, complete the stamp duty assessment form and submit it to KRA along with copies of the sale agreement and title deed. After KRA processes your application, you’ll receive an assessment notice detailing the exact amount due.

Payment can be made through various channels including KRA’s online platform, bank transfers, or designated banking halls. Once payment is confirmed, KRA issues a stamp duty certificate, which is essential for completing the land transfer process.

Additional Costs to Consider

Beyond stamp duty, land transfers in Kenya attract other mandatory fees. These include land search fees (typically KSh 500-1,000), legal fees for conveyancing services, valuation fees if required, and registration fees charged by the Ministry of Lands.

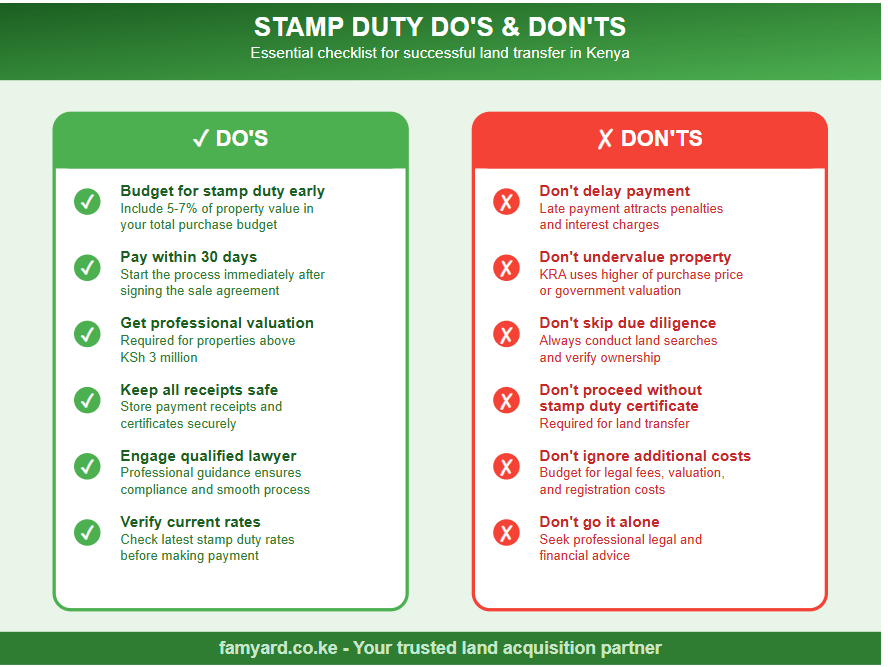

Budget approximately 5-7% of the property value for all transfer-related costs, with stamp duty forming the largest component of this expense.

Consequences of Non-Payment

Failing to pay stamp duty within the stipulated timeframe attracts penalties and interest charges. The longer you delay, the more expensive the process becomes. Additionally, you cannot complete the land transfer or obtain clean title documents without clearing stamp duty obligations.

Tips for Property Buyers

Always factor stamp duty into your property purchase budget from the beginning. Obtain current valuation rates from the Ministry of Lands website or consult with a registered valuer to estimate your obligations accurately. Consider engaging a qualified lawyer to guide you through the entire process, ensuring compliance with all legal requirements.

Keep all payment receipts and certificates safe, as these documents are crucial for future property transactions or disputes. Remember that stamp duty rates can change, so verify current rates before making any payments.

Understanding stamp duty helps you make informed decisions when purchasing land in Kenya. While it represents a significant cost, proper planning and budgeting ensure a smooth property acquisition process.

Ready to make your land purchase in central Kenya? Visit Famyard.co.ke for expert guidance on property transactions, current market rates, and comprehensive support throughout your land buying journey. Our experienced team ensures you navigate every step confidently, from initial search to final registration.